Tom Cotton should go further: An endowment tax should not exclude big foundations

NEWYou can now listen to Fox News articles!

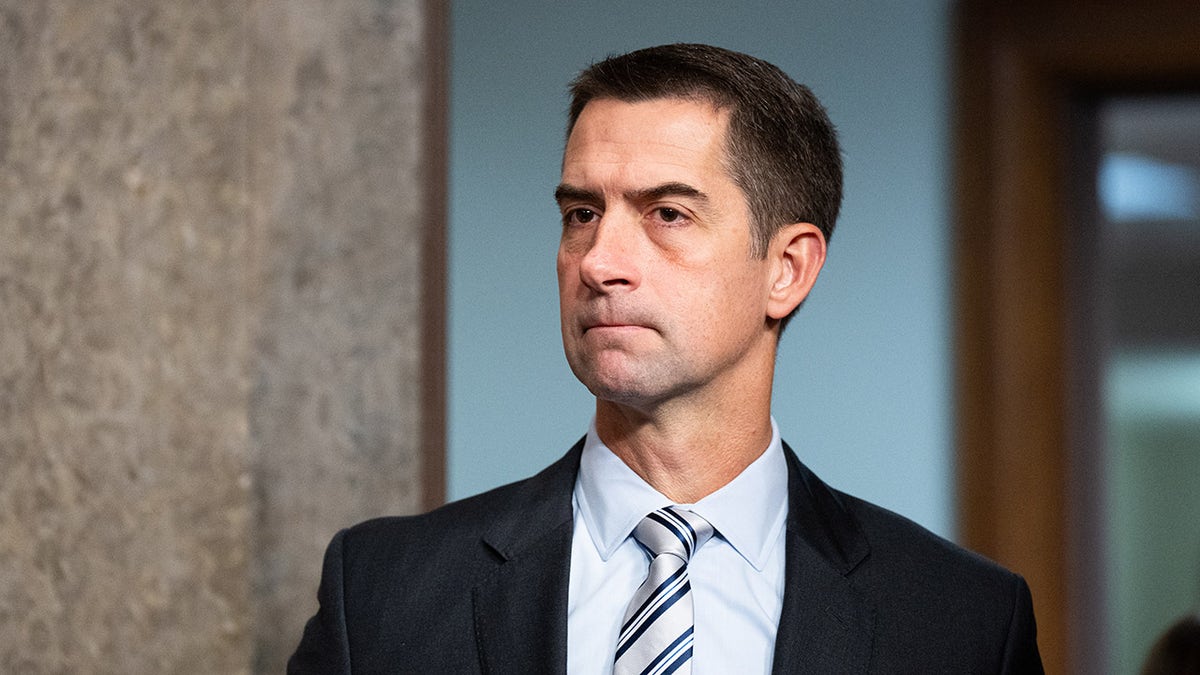

Pressure in Congress is rapidly growing to respond to the Left-leaning tilt of universities by increasing the excise tax on their endowments. There’s no doubt that for legislators concerned about both the quality of education and looking for a way to raise revenue without increasing tax rates, endowments such as Harvard’s $50 billion or Yale’s $40 billion endowments, buoyed by tax-exempt gifts, are an inviting and not inappropriate target. Arkansas Sen. Tom Cotton has proposed a one-time tax on such large holdings in order to raise $16 billion.

But there’s another similar group of endowments that should get Congressional attention: the fast-growing financial holdings of the largest private foundations, which are both almost all ultra-Progressive and even less accountable than universities. Ford, Bloomberg, MacArthur and their kin don’t have to rely on either student tuition or federal grants. They are insulated from any market test or political pressure and are “self-perpetuating”; their board members name their own successors.

The largest foundations today include the Ford Foundation ($16 billion), which focuses its grantmaking on reducing income inequality, the Rockefeller Foundation ($6 billion) which aims to reduce fossil fuel use (although they were the source of its wealth); Hewlett ($14 billion), which focuses on climate change, the Kellogg Foundation ($14 billion) which emphasizes “racial healing”; and George Soros’ Open Society foundations ($23 billion), which has promoted cannabis legalization and criminal justice reforms, including the soft-on-crime approaches of prosecutors like New York’s Alvin Bragg, who prosecuted Donald Trump.

COLUMBIA UNIVERSITY YIELDS TO TRUMP ADMIN DEMANDS OVER REVOKED $400M IN FEDERAL FUNDING

It’s no wonder that JD Vance has characterized such foundations as “cancers on American society that pretend to be charities.” He described their endowments as “ill-gotten wealth” funding “radical left-wing ideology”.

Their endowments are not only large but have been growing quickly. According to FoundationMark, which relies on publicly available data, “U.S. foundation assets rose nearly $200 billion in 2023 to set a new record and top the $1.5 trillion mark for the first time. “

“Over the past five years, foundation assets have grown from $1 trillion in 2018 to the current high due to a favorable investment climate and strong incoming contributions.”

In other words, wealthy donors themselves are also tax-advantaged, through their deductibility of up to 30 percent of income. Such giving totaled $103 billion in 2023. The foundations themselves pay a minimal 1.39 percent excise tax on their asset appreciation, aka capital gains.

The point here is not to punish foundations for their philanthropic preferences. Nor should we consider going so far as Vance’s proposal to “seize their assets”. That would be a cure far worse than any disease. There are, after all, right-of-center foundations, as well, though they are smaller and fewer in number. Rather, the goal should be to decrease foundation size so that, in effect, they are pushed toward “sunsetting”—going gradually out of business as their boards become more detached from the original goals of donors and boards of so-called “philanthropoids” take over and pay large salaries to foundation executives. Bill Gates has already planned to do just that, with his foundation, the nation’s largest ($75 billion). Most famously, Henry Ford II resigned from the board of his eponymous foundation in 1976 because he felt its grantmaking had become divorced from its sources of wealth. In his resignation letter, Ford denounced its “anti-capitalist drift” and a “fortress mentality” among its staff.

Even more important, by raising taxes on foundations, Congress can help pay for a change in the tax law to restore an incentive for individual taxpayers to make charitable contributions. As it stands, more than 90 percent of taxpayers use the “standard deduction”, which means that they can’t take advantage of the deduction for charitable giving. As a result of the 2017 Tax Cuts and Job Creation Act, the number of taxpayers who itemize their deductions fell from 30 percent to just 7.2 percent.

CLICK HERE FOR MORE FOX NEWS OPINION

We should not want charitable giving to become a luxury good—the province of just the rich and of large foundations. An endowment tax, whether on universities or big foundations, can help pay for a so-called “above the line” deduction for charitable giving which any taxpayer could use. There’s precedent for this. Democrats actually included a $300 deduction in their Covid-era CARES Act. Those deductions—which reduced taxes by $4.8 billion—boosted charitable giving at a time it was desperately needed. We can never tell when such a time will come again. It’s important that charitable giving not be disproportionately concentrated.

CLICK HERE TO GET THE FOX NEWS APP

It’s worth noting that, even as big foundations tilt Left, individual taxpayers prefer to support such organizations as religious institutions. According to the definitive annual report, Giving USA, individual donors gave $145 billion to religion, compared to just $22 billion to environmental causes.

As Congress debates whether and how to extend the 2017 tax act, major foundations should not be exempt from change.