Stocks Mark Worst Month in Years as Trump’s Tariffs Loom

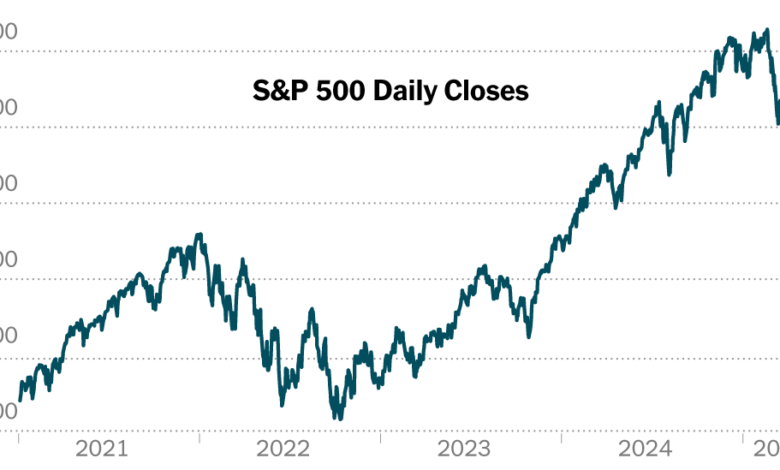

The S&P 500 ended March with its steepest monthly decline in more than two years, driven by uncertainty about the scope of President Trump’s tariffs, which investors fear could accelerate inflation, slow consumer spending and stall the U.S. economy.

After a choppy session on Monday in which the index ended higher for the day, the S&P 500 registered a 5.8 percent decline in March, its worst month since December 2022, when the Federal Reserve embarked upon a series of sharp interest rate increases as it sought to tame inflation. The decline in March caps off the S&P 500’s worst quarter at the start of a president’s term since President Barack Obama took over in 2009 during the financial crisis.

The benchmark is now down 8.7 percent from its mid-February peak, a downturn that is near a 10 percent “correction,” denting the values of portfolios and retirement funds across both Wall Street and Main Street. The technology-heavy Nasdaq Composite index, which has already slipped into a correction, ended the month down 8.2 percent.

Since taking office a little over two months ago, Mr. Trump has kept investors and companies guessing with a haphazard rollout of what he calls an “America First” trade policy. He has threatened, imposed and in some cases then paused the start of new tariffs on goods coming into the United States.

Whiplash over trade policy has fueled market volatility in the first few months of the year. Mr. Trump’s next round of tariffs, set to be unveiled on Wednesday, could bring additional market swings in the coming days.

“That’s what the market is hoping for after April 2: Give us what you’re going to give us, tell us what’s going to happen and we will then try to figure it out,” said Steve Sosnick, the chief strategist at Interactive Brokers. “But until then, it’s very difficult to invest.”

Stocks had rallied in the wake of Mr. Trump’s election, buoyed by Wall Street’s hopes for deregulation and tax cuts. But the post-election rally lost steam as tariffs began to take center stage in Mr. Trump’s early economic policy priorities.

More recently, Mr. Trump has acknowledged but dismissed the potential financial hit to consumers and businesses from sweeping tariffs, eroding hopes that shaky markets would cause him to reconsider his actions. On Saturday, Mr. Trump said he “couldn’t care less” about the prospect of higher car prices in an interview with NBC’s “Meet the Press.”

Investor optimism about the U.S. markets peaked at the start of the year, as investors anticipated more business-friendly policies, said Lauren Goodwin, an economist at New York Life Investments. But those hopes are being questioned, she said, pointing to high levels of uncertainty — not just on tariffs but also related to Mr. Trump’s immigration policies, which are clouding the outlook for the labor market.

“From an economy that was at risk of overheating from all the good things happening, that’s an almost 180 degree shift in one quarter,” Ms. Goodwin said.

Analysts at Goldman Sachs cut their forecast for the S&P 500, citing “higher tariffs, weaker economic growth and greater inflation than we previously assumed” in a note on Sunday. They expect the index to fall another 5 percent in the next three months. The downturn could be deeper if the U.S. economy slipped into recession, which the analysts give a roughly one-in-three probability.

Investor anxiety has been reflected in other markets. The price of gold hit another record high, trading at around $3,150 per ounce on Monday. Gold is often sought by investors during times of turmoil. Traders also parked money in relatively safe U.S. government bonds, pushing the yield on the 10-year Treasury note below 4.2 percent, a sign of investors’ concerns about economic growth.

Expectations for interest rate cuts from the Federal Reserve have nudged higher, with investors now betting on three cuts this year, according to CME FedWatch. The Fed has opted to pause until it gets more clarity about what Mr. Trump will enforce and how consumers and businesses will respond. Most Fed officials are bracing for higher inflation and lower growth this year.

On Monday, stocks in Japan and Taiwan fell more than 4 percent, while share prices in South Korea were down 3 percent. The Nikkei 225 index in Japan fell into a correction, down 12 percent from its high in late December. Technology companies were hit hard: Chipmakers Taiwan Semiconductor Manufacturing Company, SK Hynix, Samsung and Tokyo Electron recorded declines.

Losses in China were more muted. Hong Kong stocks dropped more than 1 percent and those in mainland China were about 0.5 percent lower. Mainland stocks got some support from a report signaling that China’s export-led industrial sector continues to expand despite Mr. Trump’s initial tariffs.

Markets in Europe also slumped, with the Stoxx 600 index falling 1.5 percent. German automakers, which are particularly exposed to U.S. tariffs, extended recent losses: Volkswagen, Europe’s largest carmaker, dropped more than 3 percent in Frankfurt.

At one point on Monday, the S&P 500 fell more than 1 percent, but ended the day up slightly.

Mr. Trump has imposed tariffs to make imports more expensive in industries like automobiles, arguing that the trade barriers will spur investment and innovation in the United States. He has also used tariffs, and their threat, to try to extract geopolitical concessions from countries. He has further unnerved investors by saying he does not care about the fallout of his actions on markets or American consumers, who will have to pay more for many goods if import prices rise.

Over the weekend, Mr. Trump ramped up the pressure, threatening so-called secondary sanctions on Russia if it does not engage in talks to bring about a cessation of fighting in Ukraine. The tactic echoes similar sanctions concerning Venezuela. He said last week that any country buying Venezuelan oil could face another 25 percent tariff on its exports to the United States.

The threats over the weekend come on top of tariffs of 25 percent on imported cars and some car parts set to be put in place this week, barring any last-minute reprieve. That’s in addition to previously delayed tariffs on Mexico and Canada, as well as the potential for further retaliatory tariffs on other countries.

Adding to investors’ angst is the scheduled release on Friday of the monthly report on the health of the U.S. jobs market. It could provide another reading of how the Trump administration’s policy pursuits are weighing on the economy.

“I hear it from nearly every client, nearly every leader — nearly every person — I talk to: They’re more anxious about the economy than any time in recent memory,” Laurence D. Fink, the chief executive of the asset management giant BlackRock, wrote on Monday in his annual letter to investors. “I understand why. But we have lived through moments like this before. And somehow, in the long run, we figure things out.”

Keith Bradsher and Jason Karaian contributed reporting.