America’s colleges are hoarding billions — and yet still cry poor as Trump targets federal funding

Twenty years ago, maybe even ten, I’d have found stories about the administration cutting grants to universities and detonating thousands of campus-related jobs horrifying.

But the education sob stories now flying off the presses have a gigantic lie of omission.

Take Johns Hopkins.

NBC News was one of many to highlight the “grave consequences” the new administration’s policies have had on the famed institution, noting “the changes will also have an economic impact in Baltimore because the university is the largest private employer in Maryland.”

NBC pointed out that “about half of Johns Hopkins’ funding last year came from federal research dollars, according to a letter from Ron Daniels, the university’s president.”

It seemed odd that the “largest private employer in Maryland” is half-funded by the federal “research dollars,” but I shrugged and went to the Johns Hopkins website to read the Daniels letter.

When there’s money on the line and university presidents have time to compose their thoughts, expect the ultimate in soaring magniloquent resplenditude.

Daniels didn’t disappoint.

In a letter titled “Our bond in a moment of challenge,” he explained that Johns Hopkins holds “a particular place in the firmament of American, indeed, international higher education.”

Indeed, the firmament!

More: “Because of our researchers’ extraordinary success in competing year after year for merit-based grants and contracts, we are, more than any other American university, deeply tethered to the compact between our sector and the federal government. Last year, for instance, nearly 50% of our total incoming funds was derived from research conducted on behalf of the federal government . . .”

Well endowed

A short trip on the JHU site later I found myself at the Johns Hopkins Public Interest Investment Committee annual report, published in January.

There, I learned that “as of June 2024, JHU’s endowment comprised more than 4,700 funds, each supporting specific purposes, schools, or faculty — totaling roughly $13.5 billion.”

This was a 23% jump over the previous year, a roughly $2.5 billion increase.

Speaking of “our bond,” JHU has three corporate bond funds worth $1.37 billion.

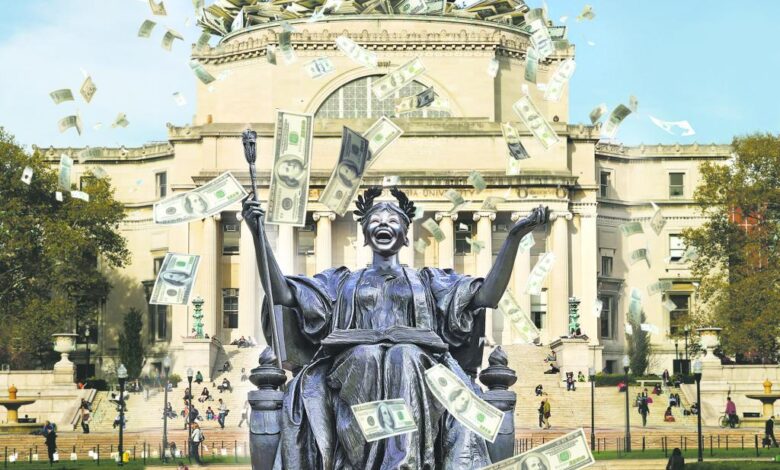

Columbia is in even better shape, holding a $14.8 billion endowment as of last June.

But that’s not all.

As student loan activist and presidential candidate Alan Collinge points out, the school is also sitting atop $3.7 billion in undesignated cash reserves, above its endowment.

Remember, papers like The New York Times have been pumping out story after story about Columbia with the same angle: “Pediatricians tracking the long-term health of children born to mothers infected with the coronavirus during pregnancy. Scientists searching for links between diabetes and dementia . . . [all] abruptly terminated . . .”

No one ever mentions that Columbia itself could probably fund treatment for those children, diabetics and dementia patients without taking the unthinkable step of touching its endowment.

They’re choosing not to.

No matter what you feel about the cuts, watching a cash machine like Columbia plead poverty is obscene.

Hidden cash reserves

I first came across the issue of universities sitting on hidden cash reserves at Rolling Stone years ago, when Collinge told me about an extraordinary slip-up in the state of Wisconsin.

University of Wisconsin president Kevin Reilly in 2013 blurted in a state hearing that his school was sitting on $648 million in reserves, also above endowment.

This number had jumped 62% in the previous two years, at the end of a period in which tuition had jumped 5.5% a year from 2007 on.

This was revealed in the context of a proposal for the state of Wisconsin to add $181 million in taxpayer aid to UW’s allegedly ailing budget.

“The good news is, no dollars have been reported missing,” was the sheepish quip of Gerald Whitburn, chairman of the UW Regents’ Budget, Finance, and Audit Committee.

Collinge in 1999 graduated from USC with a degree in aerospace engineering, lost a job, and saw his $38,000 in loans balloon to $100,000.

Drunk on a couch, he swore he’d find a way to get Sallie Mae on “60 Minutes” if it was the last thing he did.

“Lo and behold, I ended up being interviewed by Lesley Stahl within about a year,” he said.

‘Pretend they’re poor’

Collinge’s site, StudentLoanJustice.org, became what he called a “complaint box for the industry,” focusing among other things on the scammish financial setup of higher education.

“The colleges are more awash in cash today than at any point in US history, even adjusting for inflation,” he says.

“But here we have them just falling over themselves trying to pretend they’re poor.”

Universities are so adept at marketing that few voters realize they’re pulling a triple or quadruple heist at taxpayer expense.

First because federal pols have been committed for so long to financing state-backed loans for “every student who wants to go to college,” and second because of the harsh reality that anyone who wants even a secretarial job now must get a secondary degree (even though the degree doesn’t guarantee a job or even come close), colleges are essentially market-immune.

They live off giant subsidies in the form of limitless federal lending, which allows them to raise prices endlessly and spend endlessly on administrative bloat, rarely passing savings to students while always fattening endowments.

Administrators are such relentless grifters that they build ludicrous climbing walls, zip-lines, and water slides at monstrous expense before considering lowering costs.

Even mediocre schools now feature more contracting waste than the average Forward Operating Base, with terraced wet-decks and mansion dormitories appearing as giant middle fingers to the taxpayer: GENEROUSLY FUNDED BY YOUR GINORMOUS FEDERAL LOANS.

Between the Davos-style architecture projects and annual gloating headlines about the endowment gains schools like JHU and Harvard tend to with the care of British gardeners, any complaints from universities about the loss of even large amounts of federal dollars is hard to take.

It’s easy to feel sorry for affected workers and researchers, but these are ultra-wealthy institutions who despite being run by (in many cases) utter morons have been gifted a profitability model more riskless than too-big-to-fail banking or NFL ownership.

It’s almost impossible for Ivy League schools to lose money, which makes one wonder about professors who say they’re being “picked apart and destroyed” because their school is losing $400 million of taxpayer funds while sitting on $20 billion in assets (or in the case of Harvard, losing $686 million when it’s sitting on $53 billion).

Do they know what that sounds like?

‘Myopic & exploitative’

Still, paying taxes to subsidize high tuition, gaudy construction and an explosion of non-academic labor might be tolerable, if universities were educating the young and conducting good research.

Schools have instead become public-private hodge-podges existing in what Austin Powers would call a “consequence-free environment,” responsive neither to the market (which would demand superior teaching or affordability) nor voter preference (same).

They compete on status, handing out degrees in self-obsession and intersectional horses–t that are useful for upper-class networking and not much else.

In the last years, taxpayers have sent hundreds of millions to support censorship, gain-of-function research, and a galaxy of idiotic DEI programs that mainly serve as job programs for skill-deficient upper-class neurotics.

I’m sure a lot of good people are being hammered by the recent cuts, and yes, there are real speech issues in play.

The reaction from academia however leads me to believe these institutions are so myopic and intrinsically exploitative that they can’t be fixed without first being taken apart.

They have to be moved back to reality, but if they won’t go on their own, what is there to do?

Reprinted with permission from Matt Taibbi’s Racket News.